ZAPPY COMPLIANCE | ZAPPY SIGNATURE

Zappy Consults proudly introduces 2 new brands—Zappy Compliance and Zappy Signature. Zappy Compliance is a Compliance Canister that puts all your compliance in electronic mode. Statutory Registers, Minutes Books and other Repositories online can be maintained electronically in a safe and secure way. Zappy Signature sells e-Mudhra DSCs with Class II or Class III DSCs with 1 or 2 or 3 years validity as per the convenience of the applicant.

In this edition, we will be seeing about the Faceless Appeal Scheme, 2020 passed by CBDT. We will have our usual Legal terms and News Bites related to notifications by MCA, SEBI, RBI, IT and GST following the article.

![]() CS Saranya Deivasigamani,

CS Saranya Deivasigamani,

CEO

FACELESS APPEAL SCHEME, 2020

The Government of India in the Ministry of Finance, Department of Revenue, Introduced Faceless Appeal Scheme, 2020 for Income Tax Appeals with effect from 25th September 2020 enabling faceless filing and hearing of appeals in income tax matters.

The appeals filed under this Scheme will be disposed of in respect of territorial area or persons or class of persons or incomes or class of incomes or cases or class of cases, as may be specified by the Board.

Boards

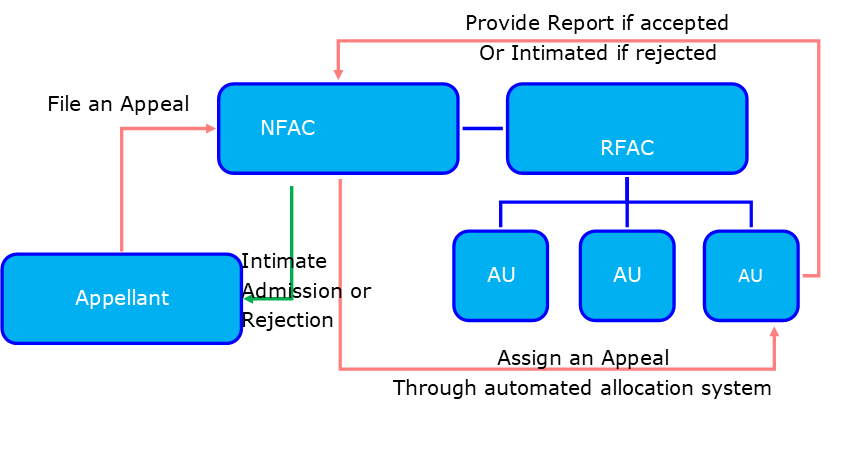

The Board may set up a National Faceless Appellate Centre (NFAC), Regional Faceless Appellate Centres (RFAC) and Appeal Units (AU).

As the name implies, NFAC deals with e-appeal proceedings in a centralized manner, which shall be vested with the jurisdiction to dispose appeal in accordance with the provisions of this Scheme.

RFAC deals with e-appeal proceedings, which shall be vested with the jurisdiction of specified region.

AUs deal with e-appeal proceedings, to perform the function of disposing appeal, which includes admitting additional grounds of appeal, making further inquiry as thinks fit, directing the National e-Assessment Centre (NAC) or the Assessing Officer (AO), as the case may be, for making further inquiry, seeking information or clarification on admitted grounds of appeal, providing opportunity of being heard to the appellant, analysis of the material furnished by the appellant, review of draft order, and such other functions as may be required for the purposes of this Scheme.

The AU shall have one or more Commissioner (Appeals) and other income-tax authority, ministerial staff, executive or consultant to assist the Commissioner (Appeals) as considered necessary by the Board.

Procedure to File an Appeal

NFAC assign the appeal to a specific AU in any one RFAC through an automated allocation system.

Where the appellant has filed the appeal after the expiration of time RFAC shall either admit the appeal in case there are satisfying reasons that the appellant had or reject the appeal and intimate to the NFAC.

Where the appellant has applied for exemption from the operation, the AU may either admit the appeal and exempt the appellant from the operation of provisions of said clause for any good and sufficient reason to be recorded in writing or reject the appeal, under intimation to the NFAC.

NFAC shall intimate the admission or rejection of appeal, as the case may be, to the appellant

Procedure on admission of appeal

The AU may request the NFAC –

(a) To obtain such further information, document or evidence from the appellant or any other person, as it may specify.

(b) To obtain a report of the NAC or the AO, as the case may be, on grounds of appeal or information, document or evidence filed by the appellant.

(c) To direct the NAC or the AO, as the case may be, for making further inquiry and submit a report thereof.

(d) The NFAC shall serve a notice upon the appellant or any other person, as the case may be, or the NAC or the AO, as the case may be, to submit such information, document or evidence or report, as the case may be, as may be specified by the AU or as may be relevant to the appellate proceedings, on a specified date and time.

The appellant or any other person, as the case may be, shall file a response to the notice within the date and time specified or as extended by NFAC on such application for extension.

The NAC or the AO, as the case may be, shall furnish a report in response to the notice within the date and time specified or as extended by NFAC on such application for extension.

Where response is filed by the appellant or any other person, as the case may be, or a report is furnished by the NAC or the AO, as the case may be, the NFAC shall send such response or report to the AU, and where no such response or report is filed, inform the AU.

Any application related to appeal, extension of time, additional ground of appeal, additional evidence, etc., the applicant will submit such application to NFAC. NFAC shall then assign the application to the AU or NAC or the AO as the case may be.

On verifying the details of the application AU or NAC or AO as the case maybe either furnish their comments or accepts or rejects the application and provide the report or intimate the rejection to the NFAC. In return, NFAC intimates the admission or rejection of the application to the Appellant.

Where the aggregate amount of tax, penalty, interest or fee, including surcharge and cess, payable in respect of issues disputed in appeal, is more than a specified amount, send the draft order to an AU, other than the AU which prepared such order, in any one RFAC through an automated allocation system, for conducting review of such order.

In any other case, examine the draft order in accordance with the risk management strategy specified by the Board, including by way of an automated examination tool, whereupon it may decide to — finalise the appeal as per the draft order; or send the draft order to an AU, other than the unit which prepared such order, in any one RFAC through an automated allocation system, for conducting review of such order;

The AU shall review the draft order, referred to it by the NFAC, whereupon it may decide to – concur with the draft order and intimate the NFAC about such concurrence; or suggest such variation, as it may deem fit, to the draft order and send its suggestions to the NFAC;

The NFAC shall, upon receiving concurrence of the AU, finalise the appeal as per the draft order.

The NFAC shall, upon receiving suggestion for variation from the AU, assign the appeal to an AU, other than the AU which prepared or reviewed the draft order, in any one RFAC through an automated allocation system.

The AU, to whom appeal is assigned shall, after considering the suggestions for variation —

(a) where such suggestions intend to enhance an assessment or a penalty or reduce the amount of refund and prepare a revised draft order as per the procedure. or

(b) in any other case, prepare a revised draft order as per procedure and send the such order to the NFAC along with the details of the penalty proceedings, if any, to be initiated therein.

The NFAC shall after finalising the appeal, pass the appeal order and-

(a) communicate such order to the appellant;

(b) communicate such order to the Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner as per sub-section (7) of section 250 of the Act.

(c) communicate such order to the NAC or the AO, as the case may be, for such action as may be required under the Act.

(d) where initiation of penalty has been recommended in the order, serve a notice on the appellant calling upon him to show cause as to why penalty should not be imposed upon him under the relevant provisions of the Act;

(e) The Principal Chief Commissioner or the Principal Director General, in charge of NFAC, may at any stage of the appellate proceedings, if considered necessary, transfer, by an order, the appeal with the prior approval of the Board to such Commissioner (Appeals) as may be specified in the order.

Penalty proceedings

AU may send recommendation for initiation of any penalty proceedings to the NFAC.

The NFAC shall, upon receipt of recommendation serve a notice on the appellant or any other person, as the case may be, calling upon to show cause as to why penalty should not be imposed upon under the relevant provisions of the Act.

The appellant or any other person, as the case may be, shall file a response to the show-cause notice within the date and time specified in such notice, or such extended date and time as may be allowed on the basis of an application made in this behalf, to the NFAC.

The NFAC shall assign the recommendation for initiation of penalty proceedings, along with the response filed, if any, by the appellant or any other person, as the case may be, to a specific AU in any one RFAC through an automated allocation system.

The AU shall, after taking into account all the relevant material available on the record, including the response filed, if any, by the appellant or any other person, as the case may be, — prepare a draft order and send a copy of such order to the NFAC. or drop the penalty after recording reasons, under intimation to the NFAC.

Where the AU has dropped the penalty, the NFAC shall send an intimation thereof, or where the AU sends a draft order, the NFAC shall pass the order for imposition of penalty as per such draft, and communicate such order, to, — the appellant or any other person, as the case may be; and the NAC or the AO for such action as may be required under the Act.

Rectification Proceedings

With a view to rectifying any mistake apparent from the record the NFAC may amend any order passed by it, by an order to be passed in writing.

Subject to the other provisions of this Scheme, an application for rectification of mistake may be filed with the NFAC by the, — appellant or any other person, as the case may be; or AU preparing or reviewing or revising the draft order; or the NAC or the AO, as the case may be.

Where any such application is received by the NFAC, it shall assign such application to a specific AU in any one RFAC through an automated allocation system.

Appellate Proceedings

An appeal against an order passed by the NFAC under this Scheme shall lie before the Income Tax Appellate Tribunal having jurisdiction over the jurisdictional AO.

Exchange of communication exclusively by electronic mode

All communications between the NFAC and the appellant, or authorised representative, the RFACs, the NAC, the AO and the AO shall be exchanged exclusively by electronic mode.

Authentication of electronic record

NFAC by affixing its digital signature. The appellant or any other person, by affixing his digital signature if he is required under the Rules to furnish his return of income under digital signature, and in any other case by affixing digital signature or under electronic verification code.

Delivery of electronic record

Every notice or order or any other electronic communication under this Scheme shall be delivered to the addressee, by way of- placing an authenticated copy thereof in the appellant’s registered account or sending it to the registered email address of the appellant or the authorised representative or uploading it on the appellant’s Mobile App and followed by a real time alert. The time and place of dispatch and receipt of electronic record shall be determined in accordance with the provisions of section 13 of the Information Technology Act, 2000 (21 of 2000).

No personal appearance in the Centres or Units.

As the name implies Faceless Appellate Centres work with no physical appearances. The hearings are conducted through telecommunication application software which supports video conferencing or video telephony.

Power to specify format, mode, procedure and processes. The Principal Chief Commissioner or the Principal Director General, in charge of the NFAC shall, with the prior approval of Board, lay down the standards, procedures and processes for effective functioning of the NFAC,RFACs and the AU set-up under this Scheme, in an automated and mechanised environment.

Legal Terms

Novation

n. The replacement of an old contract with a new one, usually substituting a new party for one of the original ones.

MCA Updates

- Clarification with regard to creation of deposit repayment reserve of 20% u/s. 73 (2) (C).

- Companies (Meeting of Boards and its powers) Third Amendment Rules 2020.

- Companies (Appointment and Qualification of Directors) 4th Amdt Rules 2020.

- Extension of time for EGM through OAVM.

- Extension of time – Scheme for relaxation of time for filing forms related to creation.

- Extension of time- LLP Settlement Scheme, 2020.

- Extension of Companies Fresh Start Scheme, 2020

- Companies (Amendment) Act, 2020

SEBI Updates

- SEBI (Debenture Trustees) (Amendment) Regulations, 2020

- Securities Contracts (Regulation) (SE and CC) (Amendment) Regulations, 2020

- SEBI (LODR) (Third Amendment) Regulations, 2020

- SEBI (ILDS) (Amendment) Regulations, 2020

- SEBI (ICDR) (Fourth Amendment) Regulations, 2020

RBI Updates

- EDPMS Module for ‘Caution/De-caution Listing of Exporters’ – Review.

- Master Circular – Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM).

IT Updates

- Income-tax (22nd Amendment) Rules, 2020

- Notification No. 81/2020

- Notification No. 80/2020

- Notification No. 79/2020

- Notification No. 78/2020

- Notification No. 77/2020

- Faceless Appeal Scheme, 2020

GST Updates

- Due dates for filing of Form GSTR-3B for the Tax Period of September, 2020

- Blocking of E-Way Bill (EWB) generation facility for taxpayers with AATO over Rs 5 Cr., after 15th October, 2020

- e-invoicing – Relaxation and latest changes

- Relief in late fees to Taxpayers filing Form GSTR-4 or 10 and change in navigation of Comparison of liability declared and ITC claimed report

- Using Matching Offline Tool to compare ITC auto drafted in Form GSTR-2B with Purchase Register

- Delinking of Credit Note/Debit Note from invoice, while reporting them in Form GSTR 1/GSTR 6 or filing Refund

- Updates on e-invoicing

'

'