Lots of Compliances

We could call July be the month of compliances. The closure of books and compliance starts with this month. Income Tax Compliance being due on 31st July. As you all aware, laws are becoming strict with heavy penalties imposed to avoid non-compliance.

In addition to the existing compliances, MCA introduced DIR-3-KYC and RBI introduced a Single Master Form (SMF) substituting all the existing reports to be submitted by the entities on Foreign Investment in India. In this edition, we will be discussing about such SMF phase introduced for FIRMS. The article will follow with the our usual Legal terms and News Bites related to notifications by MCA, SEBI, RBI, IT and GST.

![]() Saranya Deivasigamani,

Saranya Deivasigamani,

CEO

FII Reporting in single master form

The Reserve Bank, in the First Bi-monthly Monetary Policy Review dated April 5, 2018 announced that, with the objective of integrating the extant reporting structures of various types of foreign investment in India, it will introduce a Single Master Form (SMF) subsuming all the existing reports.

In order to implement this announcement, the Reserve Bank is introducing an online application, FIRMS (Foreign Investment Reporting and Management System), which would provide for the SMF. FIRMS would be made online in two phases. In the first phase, the first module viz., the Entity Master, would be made available online. Instructions in this regard were already issued through A. P. Dir. Series Circular No. 30 dated June 07, 2018.

In the second phase, the second module containing 9 reports would be made available with effect from August 01, 2018. With the implementation of SMF, the reporting of FDI, which is presently a two-step procedure viz., ARF and FC-GPR would be merged into a single revised FC-GPR. The SMF also introduces reporting of indirect foreign investment through form DI and reporting of inflows in investment vehicles through Form InVi. Further, the reporting in FC-TRS, LLP-I, LLP-II, ESOP, DRR and CN would also be made in SMF only. The finalized structure of SMF and operational instructions thereof would be made available in the Master Direction on Reporting under FEMA, 1999.

The first module will be available to the public for data entry between June 28 (at 1:00 pm) and July 12, 2018 which has now been extended till July 20, 2018. It would provide an interface for Indian entities [as defined in Foreign Exchange Management (Transfer or issue of security by a person resident outside India) Regulations, 2017 dated November 07, 2017 and as amended from time to time] to input their existing foreign investment (including indirect foreign investment) data. Entities shall provide data with respect to all foreign investments received, irrespective of the fact that the regulatory reporting to the Reserve Bank for the same has been made or not and whether the same has been acknowledged or not.

Indian entities not complying with these instructions will not be able to receive foreign investment (including indirect foreign investment) and will be treated as non-compliant with Foreign Exchange Management Act, 1999 (FEMA) and regulations made thereunder and liable for action as laid in FEMA or the regulations made thereunder.

Let us see in detail who has to comply with these regulations and the procedure for the same.

Who is an Entity?

Entity would be any one of the following category who involves in foreign investment in India.

A company within the meaning of section 1(4) of the Companies Act, 2013

A Limited Liability Partnership (LLP) registered under the Limited Liability Partnership Act, 2008

A startup which complies with the conditions laid down in Notification No. G.S.R 180(E) dated February 17, 2016 issued by Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India.

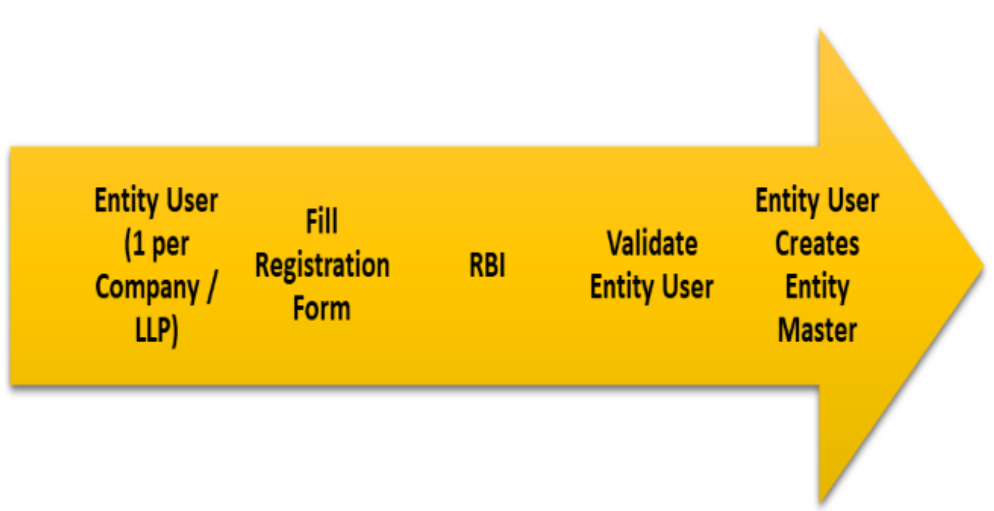

Process Flows for Entity Master

Entity User

An Entity User is a person authorized by the entity (Company/LLP/Startup) to register an entity in the Entity Master of FIRMS application.

The Entity User would be the sole person authorized to add/update the foreign investment details of an Entity in the Entity Master and would be entirely responsible for the data entered.

One entity can have only one entity user. If the entity wishes to change the Entity user, it may contact RBI helpdesk, the details of which are available under “Contact Us”.

One person can also be an entity user for more than one entity. However, the person has to obtain separate registrations for the same as the registration is entity specific.

Registration for an Entity User

For every registration there will be a Pre-requisites, for entity user registration, the pre-requisites are:

- Authority letter: The entity may issue an authority letter, in the format as given at Link 1 and Link 2 to the identified personnel authorizing him/her for registering as an Entity user for the entity.

Registration Process

- Uniform Resource Locators (URL) of the application is https://firms.rbi.org.in

- The person, for registering as Entity User, may access the login page of the FIRMS application using the above URL on the internet.

Landing page for Registering an Entity User

Creation of new Entity user

Step 1: Click on Registration form for New Entity User

Step 2: A pop-up box showing Entity User Registration form opens.

Step 3: Fill all the details in the Entity User Registration Form.

Step 4: Click on Submit button after filling all the details.

Step 5: Message “Record Saved Successfully” pops up. User has created its user ID.

Authority Letter submitted by the entity user will be verified by RBI and after RBI’s approval, the user will receive the password on their registered email ID from RBI email ID autoreply-fid@rbi.org.in.

Entity Master

Logging on to Entity Master

Enter your user name and new password.

Entry in Entity Master:

On successful login the home page (dashboard) is displayed.

Step 1: Click on the top – left option button to open Menu.

Step 2: Click on the Master Setup under Menu. Then click Entity Master.

Step 3: Click ADD button. The Entity details page is displayed.

Step 4: Click Entity Details tab. Enter the fields in the Entity Details.

Step 5: Click Particulars Tab. Enter the details.

Step 6: Click Foreign Investment in Company / LLP Tab.

(a) If Company:

Paid-up Capital of the company on a fully diluted basis (where paid up capital on fully diluted basis= paid up shares on fully diluted basis * face value) in INR

Fully diluted basis means the total number of shares that would be outstanding if all possible sources of conversion are exercised. It includes:

- Equity shares: As equity shares

- CCDS/ CCPS: Equivalent Equity shares. (If the conversion ratio is not fixed upfront, the company may enter the maximum number of equity shares possible upon conversion in compliance with the pricing guidelines)

- Share warrants: Equivalent Equity shares considering 100% exercise upfront

- ESOPs: Equivalent Equity shares considering 100% exercise upfront

Note: If a start-up company has issued, convertible notes the same shall not be included in the paid-up capital on fully diluted.

To report only Capital Instruments held by persons resident outside India on a repatriable basis

5. The Indian companies who have made downstream investment in another Indian company for which it is considered as indirect foreign investment in terms of Regulation 14 of Foreign Exchange Management (Transfer or issue of security by a person resident outside India) Regulations, 2017 dated November 7, 2017 and as amended from time to time, shall inform the same to the Indian investee company for the purpose of providing details of indirect foreign investment in Entity Master.

(b) If LLP: Total Capital contribution in LLP (in INR)

(c) Foreign Investment

The entity should also report indirect foreign investment received by it.

The entity shall provide the details of all foreign investment as on date on an aggregate level as below. This will also be inclusive of all foreign investment, irrespective of the fact that the regulatory reporting to RBI for the same has been made or not or whether the same has been acknowledged or not.

Step 7: Click Foreign Investment Info tab.

Enter all Foreign Investment received by the entity since the date of incorporation. (Details of each Issue / transfer (and not investor wise) have to be filled in this page, one after the other i.e. After entering the details of one issue user should click the Add Button (top right corner of the screen) and add the details of the next issue / transfer.)

The fields in the Foreign Investment Info tab are described in the following table.

(Note: In case a company that has created the entity master, allots shares which are not reported in the Entity Master and reports the same on e-biz, the company has to update the entity master at ‘Foreign Investment in Company / LLP’ and ‘Foreign Investment Info’)

Declaration

Step 8: After all the issues / transfers have been added, user will have to click the declaration check box to enable submission of the entity master.

Submission

Step 9: Only after the declaration is checked, the entity user can submit the details.

Once the details of the company have been submitted it will be available on the Entity Master page.

Legal Term

Plausible

(of an argument or statement) seeming reasonable or probable.

(of a person) skilled at producing persuasive arguments, especially ones intended to deceive.

MCA Updates

- Form DIR-3-KYC has been notified and available in Download Page for processing.

- Forms MGT-7, AOC-4 and Additional Attachment are likely to be revised on MCA21 Company Forms Download page w.e.f 14th JULY 2018.

- Invitation for public comments on Draft National Guidelines on Social, Environment & Economic Responsibility of Business,2018.

SEBI Updates

- Investment by Foreign Portfolio Investors (FPI) through primary market issuances.

RBI Updates

- Investment by Foreign Portfolio Investors (FPI) in Debt – Review.

Income Tax Updates

- Revision of monetary limits for filing of appeals by the DIAT, HC and SLPs/appeals before SC-measures for reducing litigation-Reg..

GST Updates

- No major notifications.

'

'