It is time to give comments our views

We hope that you are giving your valuable comments / suggestions on various amendments proposed by MCA –- on the Report of the Companies Law Committee – through an online facility made available on the MCA website up to 15th February, 2016.

- on the draft companies (Auditor’s Report) order, 2016 – may be sent latest by 23rd February, 2016 through email at caro@mca.gov.in

- on the revised Schedule III to the Companies act, 2013 for a company whose financial statements are drawn up in compliance of companies (Indian Accounting Standards) rules 2015 and as amended from time to time – may be sent latest by 23rd February, 2016 through email at sch3@mca.gov.in

CEO

Startup India

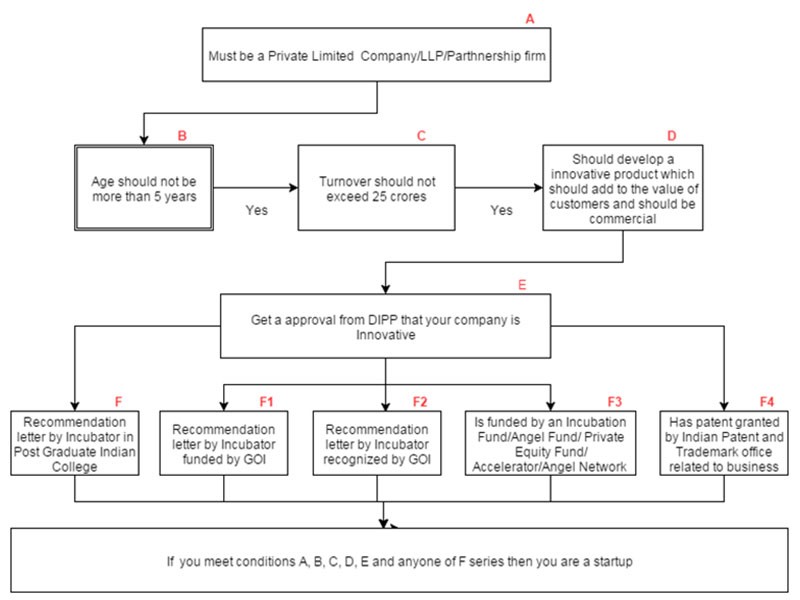

Prime Minister Narendra Modi has kicked off the ambitious Startup India Movement on 16th January 2016 at New Delhi. The government programme aims to fill gaps in the economy for the growth and development of startups and will aim to boost digital entrepreneurship at the grassroots. The government is expected to earmark around . 2,000 crore for the initiative. The Prime Minister told that his wish is to turn the youth of India from job-seekers to job-creators and told that if a Start-up can offer employment to even five people, it would be doing a great service to the nation. The areas youth innovators should focus, including crop wastage, and cyber security. The Prime Minister told a dedicated Start-up fund worth . 10,000 crore will be created for funding of Start-ups. The Start-ups will be exempted from paying income tax on their profit for the first three years. He also told that the Government is working towards fast-tracking of Start-up patent applications. Startup India is a flagship initiative of the Government of India, intended to build a strong ecosystem for nurturing innovation and Startups in the country. This will drive sustainable economic growth and generate large scale employment opportunities. The Government, through this initiative aims to empower Startups to grow through innovation and design.Eligibility

Action Plan

- Compliance regime based on self-certification: To reduce regulatory burden, startups shall be allowed to self-certify compliance with labour and environment laws. In case of labour laws, no inspection will be conducted for three years. In case of environment laws, startups under ‘white’ category would be able to self-certify compliance.

- Simplifying the startup process: A startup will be able to set up by just filling up a short form through a mobile app and online portal that will be launched in April.

- Patent protection: PM Modi said patent protection and IP rights are a major concern for Indian startups. The government will make IPR procedure transparent for start-ups.

- Fast track mechanisms of startup patent applications: In order to allow startups to realise the value of their IPRs at the earliest possible. Patent applications of the startups shall be fast tracked for examination and disposal.

- Fast track mechanisms of startup patent applications: In order to allow startups to realise the value of their IPRs at the earliest possible. Patent applications of the startups shall be fast tracked for examination and disposal.

- Panel of facilitators to provide legal support and assist in filing of patent application: Facilitators shall provide assistance for startups in filing and disposal of patent applications related to patents, trademarks and design under relevant Acts. Government shall bear the entire fees of the facilitators for any number of patents, trademarks or designs that a startup may file.

- 80% rebate on filing patent applications by startups: To enable startups to reduce costs in their crucial formative years, startups shall be provided an 80% rebate in filing patents vis-a-vis other companies.

- Relaxed norms of public procurement for startups: To provide an equal platform to startups vis-a-vis the experienced startups/companies in public procurement, startups (in the manufacturing sector) shall be exempted from the criteria of prior ‘experience/turnover’ without any relaxation in quality standards or technical parameters.

- Faster exits for startups: To make it easier for startups to exit, provision for fast-tracking closure of businesses have been included in ‘The insolvency and Bankruptcy Bill 2015’. Startups with simple debt structures may be wound up within a period of 90 days from making of an application for winding up on a fast-track basis.

- Funds of funds with a corpus of . 10,000 crore: To provide funding support for development and growth of innovation driven enterprises, Government will set up a fund with an initial corpus of . 2,500 crore and a total corpus of .10,000 crore over a period of 4 years.

- Credit Guarantee Fund: To catalyse entrepreneurship through credit to innovators across all sections of society, credit guarantee mechanism through National Credit Guarantee Trust Company/SIDBI shall be rolled out with a budgetary corpus of . 500 crore per year for the next four years.

- Exemption from Capital Gains Tax: Exemptions shall be given in case capital gains are invested in the fund of funds recognised by the government. In addition, existing capital gain tax exemption for investment in newly formed MSMEs by individuals shall be extended to all startups.

- Tax exemption for startups: To promote growth of startups, profit of startups, set up after April 1, 2016, shall be exempted from income-tax for a period of three years.

- Tax exemption on investments above Fair Market Value: In line with the exemption available to venture capital funds to invest in startups above fair market value (FMV), investments made by incubators above FMV shall also be exempted.

Legal Term

Judicis est judicare secundum allegata et probate

– A judge ought to decide according to the allegations and proofs.

MCA Updates

- Version of Form 8 LLP is likely to be modified w.e.f. 13th Feb 2016. Stakeholders are requested to plan accordingly.

- Notice inviting comments on the draft companies (Auditor’s Report) order, 2016.

- Notice inviting comments on the revised schedule III to the Companies Act, 2013 for a company whose financial statements are drawn up in compliance of companies (Indian Accounting Standards) rules 2015 and as amended from time to time.

- Notice inviting comments on the Report of the Companies Law Committee

- Report of the Companies Law Committee – February 2016

- All applications for reservation of name (INC-01) would be directed to “Central Registration Centre”(CRC) from 26th Jan 2016, as notified vide the Companies (Incorporation) Amendment Rules 2016, dated 22nd Jan 2016. The operations of CRC will commence with effect from 27th Jan 2016.

- Version of Form INC-1 is modified w.e.f 26th Jan 2016. Stakeholders are requested to plan accordingly.

SEBI Updates

- Circular on Position Limits – Jan 29, 2016.

- Know Your Client Requirements – Clarification on voluntary adaptation of Aadhaar based e-KYC process – Jan 22, 2016.

- Amendment to SEBI Circular CIR/MRD/DSA/33/2012 dated December 13, 2012 pursuant to amendment in Regulation 2(1) (b) of SECC Regulations, 2012.

- Clarification Circular on Streamlining the Process of Public Issue of Equity Shares and Convertibles – Jan 21, 2016

RBI Updates

- Regulatory Relaxations for Startups- Clarifications relating to Issue of Shares and acceptance of payments – Feb 11, 2016

- Compilation of R-Returns: Reporting under FETERS – Feb 11, 2016

- Post Office (Postal Orders/Money Orders), 2015 – Feb 04, 2016

- Definition of “Currency”, 2015 – Feb 04, 2016

- Foreign Exchange Management Regulations, 2015 – Feb 04, 2016

- Settlement of Export/ Import transactions in currencies not having a direct exchange rate – Feb 04, 2016

- Foreign Direct Investment –Reporting under FDI Scheme, Mandatory filing of form ARF, FCGPR and FCTRS on e-Biz platform and discontinuation of physical filing from February 8, 2016

- Foreign Exchange Management Regulations, 2015 – Jan 21, 2016

Income Tax Updates

- Amendment of Rules regarding quoting of PAN for specified transactions.

- Issue of refunds of smaller amounts.

- Additional Modes of Generation of Electronic Verification Code.

'

'